In today’s digital age, where the internet is a vast realm of possibilities, the topic of using stablecoins on Hidden Wiki onion links elevates questions about the practicality and security of such transactions. If you’re interested in cryptocurrency but find Bitcoin too volatile, here comes a Stablecoins digital currency.Stablecoins are a newer type of cryptocurrency gaining popularity for their commitment to lessening the price volatility that has bounded the usage of Bitcoin (BTC) and other digital assets as a mode of exchange.

Since Tether (USDT) was created in 2014 as the first stablecoins, the list has gone on and on, including Dai (DAI), USD Coin (USDC), True USD (USDT), Digix Gold, Havven’s Nomin, Paxos Standard, and Binance USD (BUSD).

However, their access to Hidden Wiki onion links, which is related to the dark web, starts a unique set of challenges and considerations. In this article, we’ll delve into the world of stablecoins, hidden wiki onion links, and the workability of their combination.

What Are Stablecoins?

A digital currency is a very significant medium of exchange and a store of value nowadays, whether you’re using the U.S. dollar or Dogecoin. Therefore, price stability is essential for those functions. As a result, policymakers keep the price stability of traditional national currencies. Furthermore, a 2 % move in a day is a landslide in forex trading of fiat currencies.

One of the most popular cryptocurrencies, Bitcoin, strike from less than $6,000 to more than $19,000 in mid-November to mid-December of 2017. However, it came down to about $6,900 in early February 2018. In recent years, it increased from less than $5,000 in March 2020 to more than $44,000 by August 2021. Even in one day, we won’t see cryptocurrencies raise or down by 10% in a 24-hour period.

Stablecoins, on the other hand, are digital currencies that claim to be backed by fiat money like dollars, pounds, shekels, rubles, etc. In contrast to Bitcoin, stablecoins’ prices stay fixed, as per whichever fiat currency backs them.

Furthermore, Stablecoins are used as stores of value or units of account, and in some cases where volatile cryptocurrencies are somehow less sensible. Different stablecoins employ diverse tactics to maintain price stability; some are centralized, while others are decentralized.

Some Examples of Stablecoins

1. Centralized Stablecoins

- Tether (USDT): It is the first and most famous stablecoin. It is declared as a reserve of real dollars -” collateral”- that is off-chain in a worldwide location by a centralized third party. Therefore, investors are confident due to its stash in the vault of a bank, and their tether is worthy enough for each dollar, maintaining the price steady. The stablecoin accounts call out 48% of all cryptocurrency trading volume. However, one issue with Tether Ltd is that it mints Tether tokens; it won’t be proven that the currency is fully backed, which is developing doubts among investors.

- Gemini Dollar (GUSD) or Paxos Dollar (PAX)/USDC: The venture capitalists, the Winklevoss twins, have developed this Gemini Dollar while blockchain was begun by Paxox and the crypto exchange platform is Coinbase. However, these stablecoins are praised by institutional investors. Therefore, all have been audited by Wall Street firms and are adaptable to local regulatory regimes. These token has become more popular due to less trust developed in Tether.

- Filecoin (OneFIL): EMOJI ICHI devised it for “decentralized money authorities.”The stablecoin for the Filecoin network is oneFIL.” It is backed by USDC and FIL, Filecoin’s native coin. Its primary purpose is to give a stablecoin for the broad development of the Filecoin network. Furthermore, it offers incentives and discounts for Filecoin storage sellers and providers.

2. Gold-backed Stablecoins

There is a huge amount of stablecoins that are backed by US dollar stored in bank vaults. As a result, weakening sentiment around the USD and the fiat. Therefore, it led to the elaboration of stablecoins backed by other assets, such as several gold-backed cryptocurrencies. These may differ in their form and usability, but all are backed by investment-grade gold.

Moreover, CACHE gold is the best among others. Each CACHE is backed of pure gold, around 1g held in vaults stored around the world. You can send a CACHE token, which is equivalent to sending 1g of gold per token. Therefore, it will be easily redeemed for physical gold at any time.

Furthermore, there is Tether Gold (XAUT) and PAX Gold (PAXG), which monitor in the same way. It is nevertheless pegged to one troy ounce of investment-grade gold. Additionally, they also have a higher minimum redemption as compared to CACHE.

3. Algorithmic Stablecoins

- TUNA (LUNA): It is a decentralized stablecoin that uses a complex algorithm to maintain stability rather than focusing on a trusted third party. TUNA LUNA balances “on-chain” reserves. For example, the funds are automatically stored in smart contracts along with supply and demand, lessening the chances of traders accidentally or intentionally annoying the price.

- Ampleforth (AMPL): It depends on a similar process. Despite physically backing each AMPL with 1 USD, it accesses a process known as a “rebase” to automatically fix the circulating supply of the cryptocurrency in response to changes in supply and demand. Moreover, if the price of Ampleforth is more than 5% above or below the USD reference price, then it will go up or down in the circulating supply in an effort in order to push the price return toward $1. Furthermore, AMPL holders always keep their share of the overall AMPL network; this rebase is proportional across all wallets.

- Dai (DAI): is competing with other stablecoins due to its wide usage while remaining decentralized and trustless. Blockchain company MakerDAO developed DAI, which is an ERC20 token whose value is fixed to the US dollar. Additionally, it will be accessed for transfers between Ethereum wallets.

Stablecoin Regulation

Stablecoins continue to be under observation by regulators, contributing to the rapid growth of the around $130 billion darknet market. It potentially affects the broader financial system. According to the International Organization of Securities Commission (IOSCO) in October 2021 said, stablecoins must be regulated as financial market infrastructure along with payment systems and clearinghouses. However, it was suggested that regulations concentrate on stablecoins that authorities regard to be systematically significant, or those that have the potential to impede payment and settlement processes.

Furthermore, politicians have raised calls for tighter regulation of stablecoins. For instance, Senator Cynthia Lummis (R-Wyoming) advocated for regular audits of stablecoin issuers in November 2021; on the other hand, some supported restrictions for the industry that were similar to those that apply to banks.

What Is the Purpose of Stablecoin?

The main objective of stablecoins is to offer a substitute for the significant volatility of well-known cryptocurrencies like Bitcoin (BTC). It also makes cryptocurrency less suitable for common transactions.

How Does Stablecoin Work?

Stablecoins were going to peg their market value to some external reference, mostly a fiat currency. They are more helpful as compared to more-volatile cryptocurrencies as a medium of exchange. Furthermore, stablecoins can be pegged to a currency, such as the U.S. dollar, to the cost of a commodity, including gold, or to an algorithm to control supply. Additionally, they keep reserve assets as collateral or through algorithmic formulas that control supply.

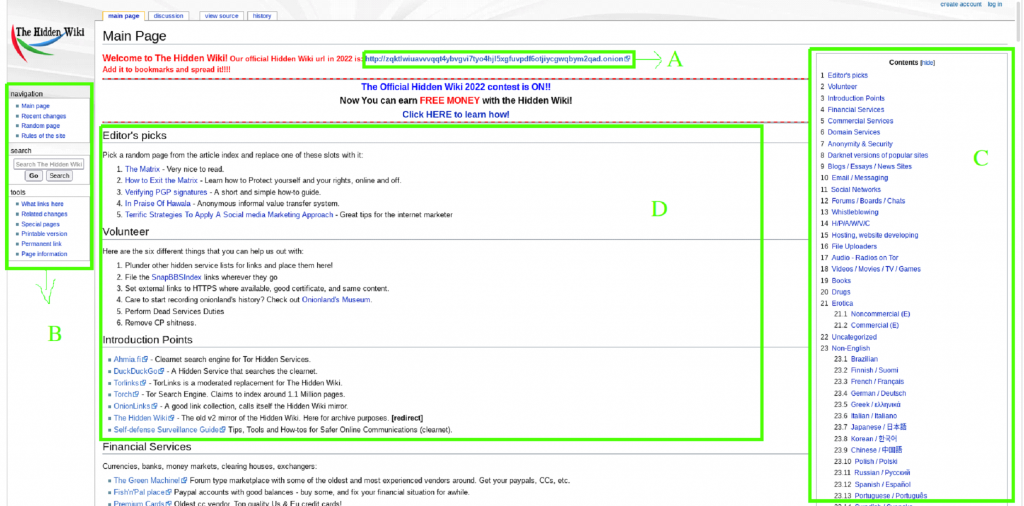

Overview Of Hidden Wiki Onion Links

The Hidden Wiki onion links indicate a website that exists on the dark web. It can only be used through particular software, like Tor. These websites contain a wide range of content, including legitimate privacy-focused communication platforms and illicit activities. Hence, the anonymity offered by the dark web has drawn the attention of individuals exploring privacy and protection from surveillance.

Can We Use Stablecoins on Hidden Wiki Onion Links?

The similarity between stablecoins and Hidden Wiki onion links displays a fascinating intersection of two relatively complex realms. Stablecoins were created to minimize price volatility, which offers a more reliable mode of transacting as compared to their more volatile competitors, such as Bitcoin or Ethereum. On the other hand, Hidden Wiki onion links are a part of the dark web that offers a platform for several anonymous activities.

Furthermore, compatibility increases with the shared need for discretion and security. Stablecoins offer an avenue for secure transactions on platforms like Hidden Wiki onion links. It also offers users the ability to engage in various services and transactions with a great degree of stability.

Exploring the Advantages of Stablecoins on Hidden Wiki Onion Links

Stablecoins come up with many advantages when accessed via Hidden Wiki onion links:

- Anonymity: Stablecoins are much similar to cryptocurrencies and can provide users with a certain level of anonymity. These links with the nature of Hidden Wiki onion links, where investors often look to maintain their privacy.

- Reduced Volatility: One of the main centers of attraction for stablecoins is their stability in value. This thing makes it unique on platforms like Hidden Wiki onion links, where price fluctuations can disturb transactions and undermine trust.

- Ease of Transactions: Stablecoins can handle flawless transactions, removing the need for intermediaries and ensuring the fastest and most efficient exchanges.

- Global Accessibility: Stablecoins will be used anywhere in the world. It also allows users on Hidden Wiki onion links to engage in transactions without geographical restrictions.

- Lower Transaction Fees: Compared to traditional financial systems, stablecoin transactions bring lower fees, making them an economical choice for users on Hidden Wiki onion links.

List of Popular Stablecoins

| USD-pegged |

| Tether (USDT) |

| True USD (TUSD) |

| Gemini Dollar (GUSD) |

| USD Coin (USDC) |

| Paxos Standard (PAX) |

| Binance USD (BUSD) |

| DAI |

| HUSD |

| sUSD (SUSD) |

| mStable USD (MUSD) |

| Ampleforth (AMPL) |

| GBP-pegged |

| Binance GBP Stable Coin (BGBP) |

| EUR-pegged |

| Stasis Euro (EURS) |

| TRY-pegged |

| BiLira (TRYB) |

| KRW-pegged |

| Binance KRW (BKRW) |

| Gold-backed |

| CACHE Gold (CACHE) |

| Tether Gold (XAUt) |

| Paxos Gold (PAXG) |

| Other |

| Petro (PTR) (oil-backed) |

| Libra (basket backed) |

Where Can I Buy Stablecoins?

All you need is an account with a crypto exchange or a digital wallet to buy stablecoins, where you can easily purchase crypto directly. However, some services will not be available in all locations. Make sure to check beforehand whether the option in your area will be either available or not. Some well-known exchanges, such as Coinbase, will offer some stablecoins, but such centralized exchanges will list only fiat-backed versions. You may use a decentralized exchange for more options, and any existing tokens can be swapped for most stablecoins.

The Top 6 Darknet Marketplaces That Accept Stablecoins

- Silk Road 3.1: one of the best darknet marketplaces, Silk Road 3.1, is famous for accepting Stablecoins such as Tether (USDT) and DAI. These stablecoins offer users a wide range of transactions with less risk of value fluctuations.

- Dream Market: It has a long-standing player in the dark web ecosystem and has integrated stablecoins such as USD Coin (USDC) into its platform. Dream Market allows users to trade in a stable digital currency without worrying about sudden price fluctuations.

- Point Marketplace: It has gained attraction for its user-friendly interface and support for stablecoins such as TrueUSD (TUSD). These features manipulate users to come into this darknet market for a secure and steady mode of exchange.

- Berlusconi Market: It is familiar for its commitment to user privacy and security. When you accept stablecoins like Paxos Standard (PAX), the platform ensures that the investors can transact without any risk of revealing their identities or dealing with price volatility.

- Versus Market: It has a unique interface and array of products. Furthermore, Versus accepts stablecoins such as Gemini Dollar (GUSD), offering users a reliable and valuable medium of exchange.

- DarkBay: It has held the stablecoin trend by allowing secure transactions with stablecoins such as BUSD (Binance USD). This integration provides users with a convenient way to make secure transactions while maintaining their financial privacy.

Which Is the Best Stablecoin on Hidden Wiki?

The most popular and greatest stablecoin by market capitalization is Tether (USDT) which is pegged to the U.S. dollar at a 1:1 ratio and backed by gold reserves. Moreover, it has in the top five cryptocurrencies by market cap. You may find Tether on most top crypto exchanges, including Kraken, Binance, and Coinbase.

| Note: Investing in cryptocurrencies and other Initial Coin Offerings (ICOs) is extremely risky and speculative. Therefore, this article does not give any recommendations regarding investing in cryptocurrencies or other ICOs. Since each individual’s circumstances are unique, an expert professional must always be consulted before making financial decisions. Hence, we are not representing or warranting you the accuracy or timelessness of the information contained herein. |

Reasons To Choose Stablecoins Over Cryptocurrencies Like Bitcoin

Stablecoins are more stable because they are supposedly backed by fiat currency. Investors are well aware that their tokens will sell for one dollar each. It means that the prices can’t fall down. Therefore, coin prices are raised by belief, so if investors believe in their stablecoins that are worthy enough and backed by one dollar each, the price must reflect that.

They’re a safe shelter for worried investors. Many exchanges, such as the world’s largest exchange, Binance, won’t let traders buy fiat. It will only allow them to buy and sell cryptocurrencies. As a result, it is quite tough for investors to cash out their cryptocurrencies when the situation gets worse. However, they may have to transfer across various exchanges or even wait for several days.

In this case, stablecoins work best. Because they are cryptocurrencies, they live on most exchanges. Furthermore, they cut the value of a single fiat currency and represent a sort of temporary refuge for investors seeking to secure their funds during a bear market. In such cases, stablecoins are the same as blockchain-enabled versions of the dollar. That’s if they keep holding on to their value.

Disadvantages of Stablecoins

Investors need proof of reserves to buy back the coins. In the case of the Tether, there were rumors that the currency was unbacked and was minted out of thin air. Stablecoins aren’t stable. Further, the Gemini Dollar has risen by a few cents at various times in the last year as traders poured some money into it.

Sarcastically, many of those users’ funds had come from Tether, which had previously dropped as low as $0.51 on some exchanges. However, stablecoins can be recognized as ‘relatively’ stable as compared to absolutely stable, particularly when contrasted to volatile assets like Bitcoin.

Tether has frequently stated that it is 100% backed by the US dollar. However, when Tether released a breakdown of its reserves in May for the very first time, it came out that less than 3% of Tethers were backed by cash.

Generally, US lawmakers are not big fans of stablecoins. According to the semi-annual monetary policy report to Congress earlier this month, Federal Reserve chairman Jerome Powell noted that stablecoins were in need of tighter regulations.

“If they are going to be a significant part of the payments universe, which we don’t think crypto assets will be, but stablecoins might be, then we need an appropriate regulatory framework, which frankly we don’t have,” the speaker stated. In a meeting with key regulators in July 2021 to “discuss interagency work” about stablecoins, President Biden’s Treasury Secretary Janet Yellen urged them to “act quickly to ensure there is an appropriate U.S. regulatory framework in place.”

Are There Any Other Risks?

In spite of the fact that stablecoins can be less volatile as compared to other forms of crypto, users are still exploring newer technology that might have unknown bugs or vulnerabilities. Additionally, there is a huge chance that you may lose the private keys that allow you access to your cryptocurrency, either through a hack or user error.

In the meantime, stablecoins had been facing a high level of regulatory uncertainty. A report composed by the Biden administration in November 2021 called for additional government errors in stablecoins. However, such changes will result in additional consumer protections. Also, they would impact different stablecoins in different ways or lead to restrictions that affect coin holders.

If you’re eager to explore cryptocurrency, think more about using some “fun money” -those dollars build up your savings and pay your essential expenses. Individual stocks will also fill that role if you want to add riskier assets to your portfolio.

FAQs About Using Stablecoins on Hidden Wiki Onion Links

Ans: Stablecoins offer a certain level of anonymity, but investors must remember that their transactions will be traceable on the blockchain.

Ans: Although stablecoins can be accessed for several transactions, it is vital to check the particular payment methods accepted by the platform you’re interested in.

Ans: Stablecoins are not illegal themselves, but their usage on the dark web will be involved in illegal activities, which is totally against the law.

Ans: You must use well-known wallets and platforms for your stablecoin transactions and enable two-factor authentication to increase security.

Ans: Cryptocurrencies such as Bitcoin and Monero are most commonly used on the dark web. However, stablecoins provide benefits in terms of stability.

Ans: Stablecoin transactions are recorded on the blockchain, but the degree of privacy precautions users take affects how easily they may be tracked.

Ans: Regardless, stablecoins offer some degree of privacy, but transactions can be traceable on the darknet blockchain.

Ans: Users must access secure wallets, enable two-factor authentication, and follow best practices for online privacy.

Conclusion

The compatibility between stablecoins and Hidden Wiki onion links brings up new possibilities for secure and stable transactions in the hidden corners of the internet.

On the other hand, stablecoins offer benefits such as anonymity and decreased volatility. However, users must go through the potential risks, such as regulatory concerns and security challenges. As the landscape of the dark web continues to progress, stablecoins will play a vital role in the face of transactions occurring on platforms like Hidden Wiki onion links.